The impact of economic and financial crises on the real estate market

Since the onset of the COVID-19 pandemic the most common questions that have been surfacing over the past months are; What is the impact of the current economic crisis and recession on the real estate market? And as a result, will real estate prices drop?

Due to everything taking place throughout the world right now, we are witnessing uncertainty and chaos throughout the global economies. The last couple of month have seen stock markets collapse and currency values fall; along with unprecedented worldwide restrictions of travel there has been a deterioration of consumer spending and sentiment thus it’s no wonder that existing and potential investors in the real estate market are worried and want to minimize their risk more than ever.

Real estate in a time of recession.

When a global recession happens, investors should not generalize the economic effect this could have on real estate worldwide. For example, in the last recession in 2008, the US was affected much more severely than the Middle East or Africa. Therefore, when investing in real estate, it is important that investors are reminded of the importance of treating each business case separately; the specific country, city, property type, or neighborhood will vary substantially as not every country gets impacted equally. While most of the world will now be overwhelmed by the turmoil of this current crisis, the proactive investor will be looking for the opportunities and deals in every market. The successful investors who know how to ride-out a recession will never sit on the sidelines, but rather know how to recognize the scope of possibilities and seize the opportunities.

Real estate is the safe haven and best alternative.

If you previously considered that investing in real estate is risky, then where else would you decide to invest at such a time? With the current volatility of the stock markets it is not clear who will be impacted and with governments weighing in to try and prop up their private sectors, investors should think very carefully before investing in the stock market at this time. When the stock market is not performing well, real estate is a beacon of safety.

In an attempt to exercise caution some will opt to do nothing; however, this will cost them! Locking up money in your bank account will keep you exposed to the risk of inflation, real estate however is known as being ‘inflation proof’. Furthermore, the real estate market has grown consistently through recessions and has proved to be much more stable when compared to performance of market indices which have historically displayed much more volatility.

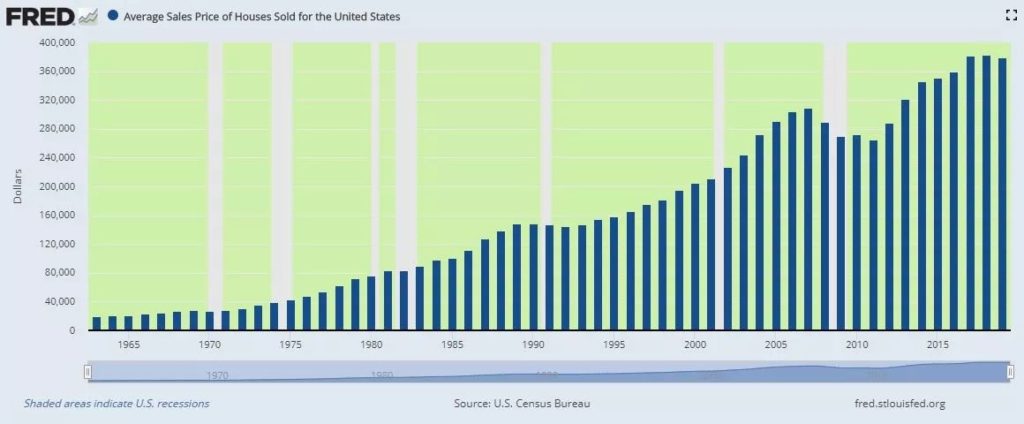

As an example, you can see from the graph above (Federal Reserve Bank of St. Louis, 2020) showing the average sales price of homes sold in the US since 1965 and indicates the times of recession in grey. Here it is clear that growth has been immune from the effects of the previous recessions with the exception of 2008 which was caused by the real estate market ‘housing bubble’. If we look at the previous recessions of 2001, 1990, 1987 and 1980 we can see that the real estate prices not only withstood the wider economic effects but actually made gains over the same period. Certainly, real estate will increase and decrease, and they will be influenced to a limited extent by economic cycles, but over time, real estate value historically always increases.

6 tips to win in a recession!

Here are six tips to keep in mind, to help investors perform well and combat the next recession:

- The best form of defense is attack. Turn a recession into opportunity as opportunity can knock at any moment!

- Don’t panic and sell at the bottom of the market. Even if prices drop, they will recover!

- Keep healthy cash reserves.

- Diversification of real estate type is always good, having a mixed portfolio of property (Commercial, Residential, Land …etc.)

- Owning international property lowers the risk of your portfolio, since the impact of the recession varies from country to country.

- You must be aware of long-term nature of this investment and understand the liquidity risk associated with real estate. Therefore, having long-term strategy will help you to minimize your risk and optimize your return.

To conclude and considering all the above; investing in the right property, at the right price and in the right location will enable you to succeed out of a recession.

Abdullah Al Tamimi

Founder & CEO, Konya Real Estate.